A credit rating can protect your company against bad payers

Do you work in a company that mainly sells to B2B customers? Then, it is a good idea that you first get the company's credit assessed. With a credit rating, you will get important financial information about your customers to determine the significant risk of doing business with them.

When your company has to deliver a product or service to a customer, it is crucial that the payment terms you have agreed to are met. But still, many companies find that their invoices are not paid, and the previously fully trusted debtors are now bad payers or may go bankrupt.

Therefore, assessing a company's credit conditions before you partner with them is often a good idea.

What is a credit rating?

A credit rating of a company is a comprehensive analysis that aims to assess the company's ability to pay for the goods or services that your company will provide to it. A credit rating often includes factors such as liquidity, solvency, earning capacity, and debt level, and it gives you insight into, among other things:

The financial health of the company.

The ability of the enterprise to meet its payment obligations.

Any financial risks.

There are, therefore, several good reasons to get a company's credit assessed before you choose to do business with it. With good routines for ongoing credit assessments of your customers, you give your company a better starting point for having a healthy operation while ensuring that you do not suffer significant financial losses.

Here are 5 good reasons to introduce good routines for the credit rating of current and potential customers.

1. You get an efficient and quick overview

A credit rating gives you a quick overview of your customers. You get access to the information clearly and intuitively, so you don't have to spend unnecessary time obtaining the necessary data to make a correct assessment of the customer. In addition, it will also help you set the correct payment terms for that customer.

2. You make assessment based on new information

How do you determine your customer's creditworthiness and ability to pay?

Many companies still choose to look at older financial statements and past results. However, it often needs to provide the correct and necessary data. If there's anything the past few years have taught us, things can change quickly.

The information must be up-to-date if you want the proper insight into your customers' financial situation. For this reason, it is recommended that you regularly carry out credit assessments of your customers to get information about essential changes in their finances before it is too late.

3. You limit the risk and avoid bad payers

One of the main reasons for making a credit rating is to uncover and limit your company's risk. Anyone who sells products or services to businesses can be hit by bad payers. There is, therefore, also a risk that this could happen to you and your company.

However, the risk can be minimized if you regularly assess your customers' credit. It can help you determine whether the customer can fulfill his financial obligations, as well as what the payment terms should look like.

4. Get more customers

As previously described, most companies are conducting credit assessments to cover risk. But it can also help you and your business seek new opportunities and get more customers.

Knowing your customers' credit rating can make your company's customer relationship more secure and thus accept even more customers. This can open the doors to new business activities and increase revenue.

5. Get help from a credit rating agency

Do you want to have a company rated for credit? Getting a credit rating agency to handle the task makes the best sense.

On kompasbank navigator, Creditsafe, and Risika can help you and your company predict paying and non-paying customers.

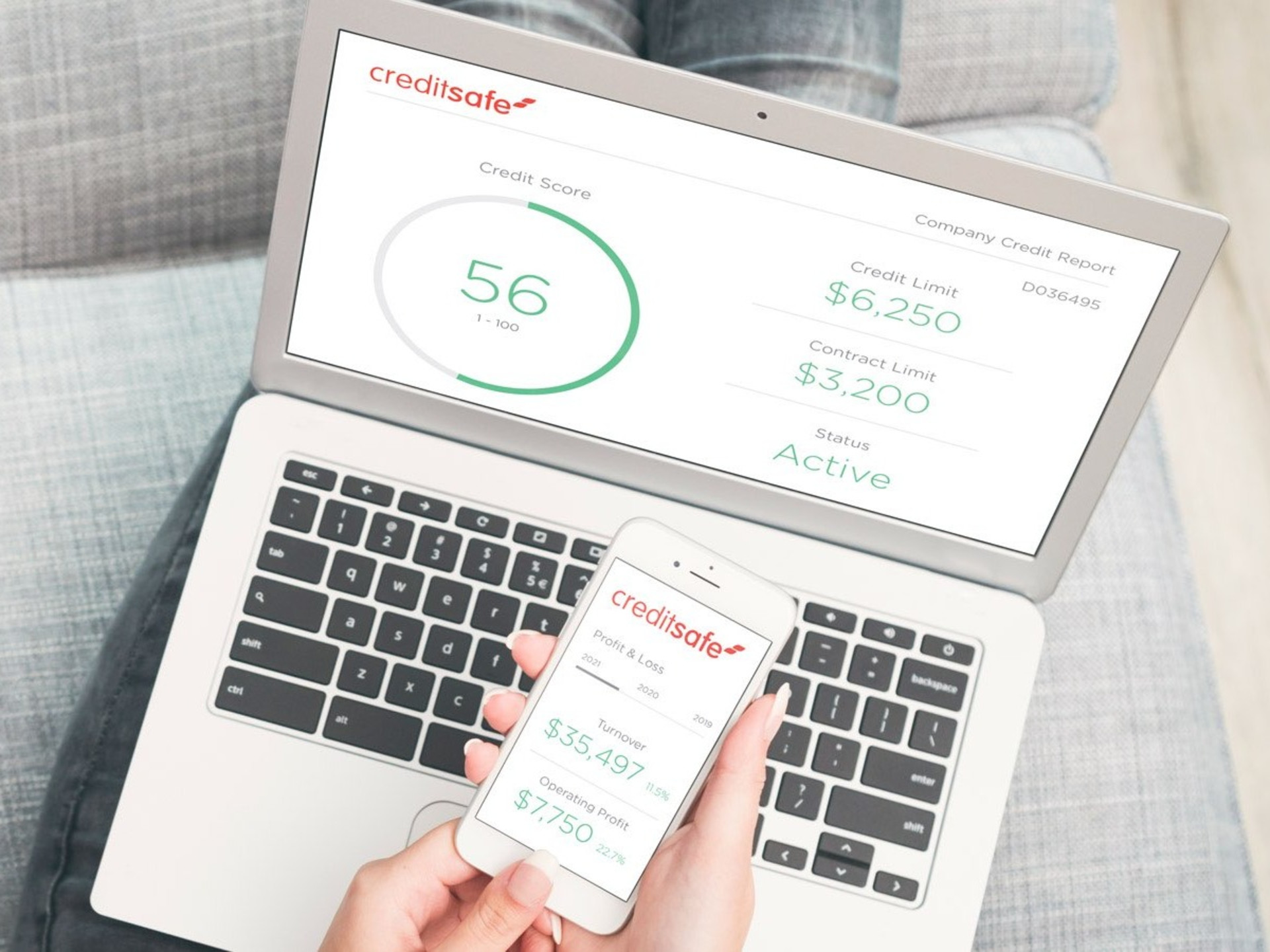

Creditsafe is the world's most widely used credit reporting agency and provides you with qualitative risk assessments, high-quality credit and financial information, and automated solutions throughout the customer journey.

Using their solution gives you a complete overview of your customer's creditworthiness and ability to pay. Creditsafe can thus help your company avoid worse payers and ensure that you do business with the right companies.

Access to credit ratings for 430 million companies.

Free support for the duration of the contract.

Tailored data services adapted to your business needs, wishes, and requirements.

Create a free profile on kompasbank navigator and get access to a 4-week trial period at Creditsafe here.

Risika is a modern credit management platform that automates your credit processes. You get access to an easy credit rating platform tailored to how you work.

At Risika, you get an easy-to-understand credit rating from 1 to 10 and credit recommendations. In addition, they send you regular updates about changes in your customers' financial situation so you can adjust your credit terms.

Automate your credit management for faster and more accurate credit decisions.

Catch potential bad-payers before the damage is done.

Make profitable decisions based on up-to-date company data for over 20 million Nordic companies.

If you have a user on kompasbank navigator, you can get a 15% discount at Risika here.

Published: 10/18/2023

Related Services

Get access to credit information

Creditsafe, the global business intelligence experts, specializes in business credit checking, credit information, and all-around B2B solutions through the entire customer journey.

Credit assessment of business customers

Risika helps companies anticipate paying and non-paying business customers through a credit rating and management platform.